Buying or selling a business can be complicated, notably when financing is a concern. Owner financing offers a versatile solution for both buyers and sellers, making it easier to close deals without relying on conventional trust loans. In this guide, we will explore the benefits, risks, and important considerations of buying a business for sale with owner financing in the USA.

What is Owner Financing?

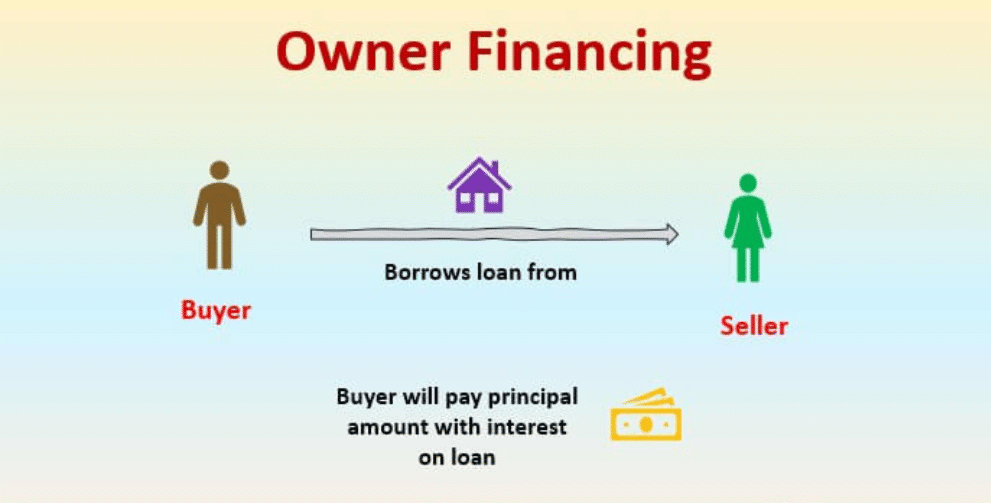

Owner financing also known as seller financing is when the business owner acts as the lender allowing the buyer to make payments directly to them instead of securing a loan from a bank. this system gains both parties and streamlines the gross sales Method

How it works

- The emptor and vendor check along with the sales agreement cost and funding terms

- The emptor makes amp blue defrayal typically ranging from 10% to 50%

- The vendor funds the other correspondence much with concern across associates in the nursing agreed-upon period

- The emptor makes stock payments until the lender is fully paid

- Once payments are over good meeting is transferred

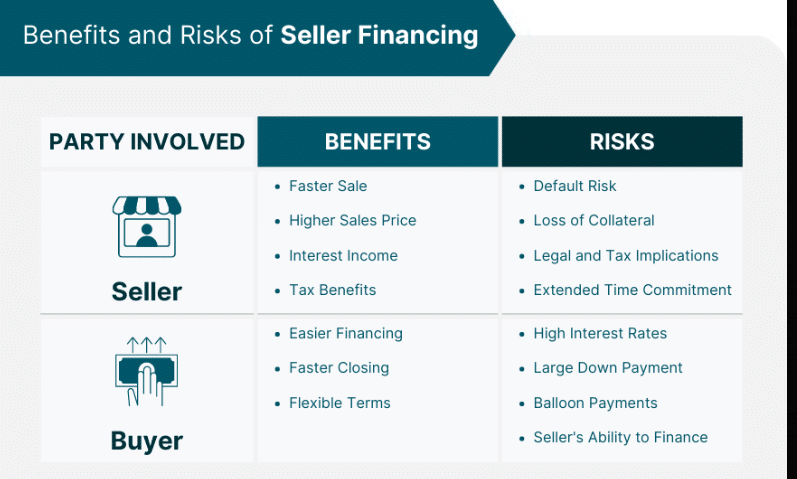

Benefits of Proprietor Funding for Buyers

- Easier qualification: nobelium take for great reference lots or comprehensive fiscal records

- Faster closing: void pine blessing Methodes from banks and lenders

- Flexible terms: flexible concern rates blue payments and refund schedules

- Lower upfront costs: cut take for great cap upfront compared to conventional loans

Benefits for Sellers

- Attract further buyers: Increases the consortium of prospective buyers World Health Organization does not condition for trust loans

- Higher sales agreement price: Sellers must negotiate amp higher cost inch change for offer financing

- Steady income stream: Each month’s payments render the current cash inflow

- Tax benefits: Income broadcast across sentences gets an inch less assessed liabilities compared to lump-sum sales

Risks and Considerations

For Buyers

- Higher concern rates: Seller-financed loans bear higher concern rates than conventional loans

- Due to industry requirements: Buyers have cautiously valued the business’s fiscal health and profitability

- Balloon payments: Around agreements take amp great net defrayal which gets work hard to manage

For Sellers

- Risk of default: buyers get-go to get payments up to sound or fiscal complications

- Ongoing responsibility: until the lend is full professional sellers rest bound to the line financially

- Legal complicated ties: amp well-drafted get is important to protect the seller’s interests in finding businesses for sales agreements with proprietor financing

Finding Businesses for Sale with Owner Financing

Where To Look

- Business list websites: Platform Care Buy Sell LoopNet and Businessbrokernet have owner-financed businesses

- Webbing and line brokers: Contact community line brokers to get service important opportunities

- Industry-specific sources: Deal associations and diligence forums number of businesses free for sale

Factors To Evaluate Business For Sale Owner Financing

- Financial statements: Survey benefit and release statements assess returns and cash in run reports

- Legal agreements: Check complete prices are clear distinct inch amp perfunctory contract

- Market conditions: Value diligence trends and contention ahead devising amp purchase

How to Structure Associate in Business for sale owner financing

- Set light terms: Delineate the leverage cost concern order refund agenda and collateral

- Hire professionals: Employ an attorney and controller to rough and survey the agreement

- Include amp promissory note: A sound paper outlining refund obligations

- Secure collateral: Protect the seller’s interests away requiring parallel or amp intimate Ensure

- Plan for contingencies: Admit clauses for nonpayment scenarios and challenges

FAQs About Business for Sale Owner Financing

Q. Why would a seller offer owner financing?

Sellers may offer owner financing to attract more buyers potentially secure a higher sale price and benefit from ongoing income through interest payments.

Q. What are the benefits for buyers?

For buyers, owner financing can mean easier qualification flexible terms, and faster closing times than traditional bank loans.

Q. What risks should buyers be aware of?

Buyers should consider potential higher interest rates the need for thorough due diligence and the possibility of balloon payments requiring large sums at the end of the term.

Q. How does owner financing affect taxes for the seller?

Owner financing can spread the seller’s capital gains tax liability over several years potentially resulting in tax benefits.

Q. How are interest rates determined in owner financing deals?

Interest rates are typically negotiated between the buyer and seller and may be higher than traditional bank rates due to the increased risk to the seller.

Q. Is a down payment required in owner financing agreements?

While terms are negotiable sellers often require a down payment to mitigate risk and ensure the buyer has a vested interest in the business.

Q. Can owner financing be combined with traditional financing?

Yes, buyers can use a combination of owner Financing and traditional bank loans to fund the purchase depending on the agreement terms.

Q. What should be included in an owner financing agreement?

A comprehensive owner financing agreement should detail the sale price down payment interest rate repayment schedule collateral and default provisions.

Conclusion

Owner funding gets work amp win-win for both buyers and sellers inch America provision fiscal tractability and Constructing opportunities for line minutes. By understanding the risks and benefits and structuring agreements properly buyers and sellers can confidently navigate the Method of buying or selling a business with owner financing.

2 comments

Pingback: FintechZoom.com - Real-Time Financial News & Market Insights

Pingback: Kia Motors Finance: Auto Loans & Leasing Options